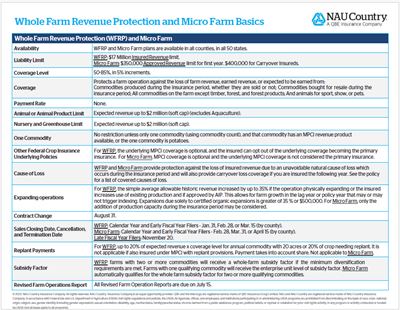

Whole Farm Revenue Protection (WFRP) and Micro Farm

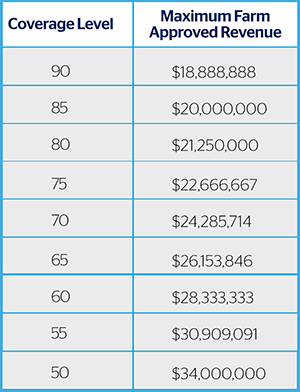

WFRP provides a risk management safety net for all commodities on the farm under one insurance policy. This insurance plan is tailored for any farm with up to $17 million in insured revenue, including farms with specialty or organic commodities (crops and livestock) or those marketing to local, regional, farm-identity preserved, specialty, or direct markets.

Like WFRP, Micro Farm provides the same protection on a smaller scale. Micro Farm is tailored for any farm with up to $350,000 in approved revenue or $400,000 for carryover insureds.

WFRP and Micro Farm insurance provide coverage against the loss of revenue that your insured expects to earn or will obtain from commodities they produce or purchase for resale during the insurance period under one insurance policy.

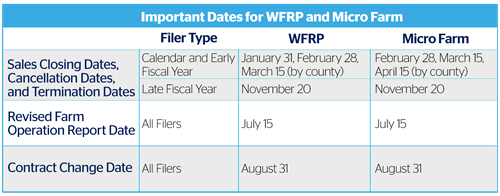

Availability and Important Dates

WFRP and Micro Farm are available in all 50 states.

Important Dates*

*Talk to your NAU Country Marketing Representative or Agent about the specific dates that apply to your county.

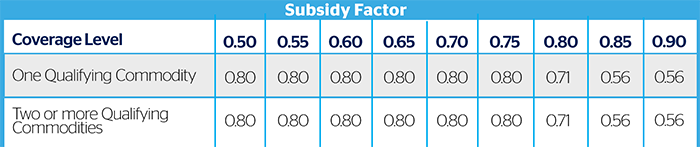

WFRP subsidy factor through diversification

The subsidy factor for WFRP makes it a very affordable policy. The amount of the subsidy factor is based on the commodity count calculation indicating the amount of farm-level diversification of revenue had by a farming operation.

Whole Farm level premium subsidy and diversification discounts if the insured qualifies with two (2) or more commodities. Farms with one qualifying commodity will receive the enterprise unit level premium subsidy. Micro Farm automatically qualifies for the Whole Farm subsidy.

What information is needed?

- Five years of historic farm tax records, and expected revenue worksheets for each year, except:

- Micro Farm, and Veteran or Beginning Farmer or Rancher qualified insureds may qualify with fewer years.

- If unable to physically farm one of the required five (5) historic years, but was farming the past year, the insured will need the four (4) years of tax records that they have. They must have earned farm revenue for the last year (the year previous to the insurance year).

- Tax-exempt entities will need acceptable third-party records that can be used to complete Substitute Schedule F tax forms for the history period.

- An Expected Value and Yield Documentation Certification Worksheet. Part 3 must be completed for Micro Farm policies.

- A Farm Operation report for the year to indicate what commodities are planned to be produced, the expected quantity, and the expected revenue for each commodity. Some of the historical records may be needed to assist with determining expected yields and prices. If organic commodities are raised, an organic certificate will be needed, and we may need to consult their organic plan.

- MPCI Average Yields and summaries of coverage for any individual insurance policies that have been purchased.

- A Yield and Revenue Report certifying acreage and production for the most recent four (4) to ten (10) years (if available) to determine the expected yield for any WFRP commodity without underlying MPCI, plus verifiable records if requested by NAU Country.

- Three (3) to five (5) years of acre and revenue history for Micro Farms.

- Farm marketing records are acceptable records for direct market commodities.

- Beginning Inventory and Accounts Receivable Reports.

- Market Animal and Nursery/Accounting Worksheet (if applicable).

- A Pre-acceptance Worksheet or applicable Underwriting Report for perennial commodities.

NAU Country has made dedicated efforts in all facets of our team to become the Whole Farm Revenue Protection and Micro Farm experts, providing you with the most knowledgeable staff in the industry. We have implemented a structure to ensure there are specialized staff members in the fields of Underwriting, Marketing, Compliance, and Claims, so the American farmer can rest easy knowing they are in the best hands.

Summary of changes for 2026

The following changes are included to conform with the One Big Beautiful Bill Act:

- Update the Beginning and Veteran Farmers and Ranchers' additional subsidy percentages;

- Increase the subsidy percentages on 75%-85% coverage levels for single commodity WFRP policies; and

- Allow eligible producers to qualify for 90% coverage level.

Training materials

- 2026 Comprehensive Whole Farm Revenue Protection (WFRP) and Micro Farm Training - Webinar

- 2026 Whole Farm Revenue Protection and Micro Farm Update - PowerPoint Presentation

Resources

- WFRP Fact Sheet

- NAU Country WFRP Claims Process Documentation

- Micro Farm Fact Sheet

- Fact Sheet – WFRP Guidance for Lenders

- 2026 WFRP FAQs

- 2026 Micro Farm FAQs

- WFRP Pilot Policy Provisions (released 2025)

- Micro Farm Provisions

- 2026 WFRP Handbook (October 2025)

- RMA/USDA Whole-Farm Revenue Protection (WFRP) Website